Yearly tax calculator

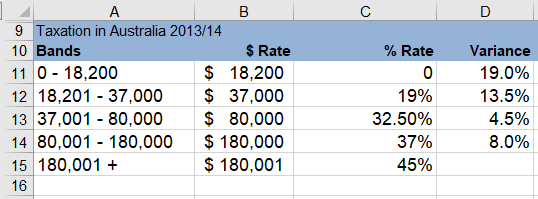

You can personalise this tax. It can be used for the 201314 to 202122 income years.

Paye Tax Calculator Sale Online 50 Off Www Ingeniovirtual Com

Using the United States Tax Calculator Using the United States Tax Calculator is fairly simple.

. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Next select the Filing Status drop down. Simple tax calculator This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

2019 Tax Calculator 01 March 2018 - 28. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Tax Changes You Need to Know on RA 10963 TRAIN 2017 Philippine Capital Income and Financial Intermediation Statistics.

A tax calculator for the 2019 tax year including salary bonus travel allowance pension and annuity for different periods and age groups. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. That means that your net pay will be 40568 per year or 3381 per month.

Use our free income tax calculator to work out how much tax you should be paying in Australia. It will not include any tax credits you may be entitled to for example the independent earner tax. Ad Analysis from Leading Practitioners and the Resources You Need to Make Informed Decisions.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. For the 2016-17 financial year the marginal tax rate for incomes over 180000 includes the. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Ad Plan Ahead For This Years Tax Return. Enter your Annual salary and click calculate. Use this free tax return calculator to estimate how much youll owe in federal taxes using your income deductions and credits in just a few steps.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. The Annual Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National. That means that your net pay will be 43041 per year or 3587 per month.

The Australian salary calculator for 202223 Annual Tax Calculations. File Income Taxes For Free. As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022.

These rates are applicable for the assessment year 2022-23 during which taxes for the year 2021-22 are. Use this calculator to work out your basic yearly tax for any year from 2011 to the current year. Philippine Public Finance and Related.

The Annual salary calculator for Australia. Expert News Commentary Trusted Analysis Time-saving Practice Tools. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

First enter your Gross Salary amount where shown.

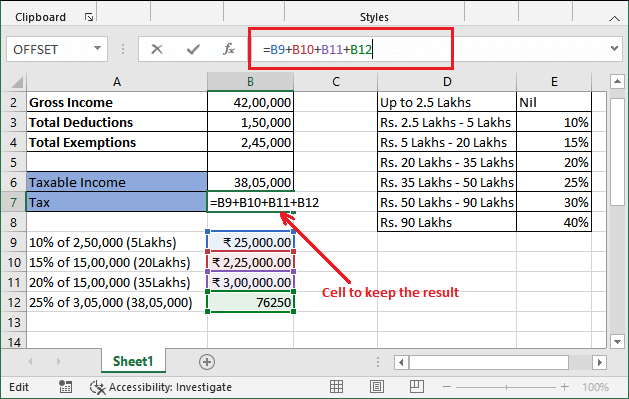

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Income Tax Calculating Formula In Excel Javatpoint

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Online Income Tax Calculator Top Sellers 55 Off Www Ingeniovirtual Com

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Excel Formula Income Tax Bracket Calculation Exceljet

Income Tax Calculating Formula In Excel Javatpoint

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel